Central Bank of Nigeria, CBN, has empowered a total of 310 youths, including members of the National Youth Service Corps as the bank on Thursday doled out N930m for them to establish profitable ventures in different sectors of the economy.

Each of the youth, who emerged through a rigorous competitive process, received N3m under the Youth Entrepreneurial Development Programme. The first set of the loans was disbursed through Heritage Bank.

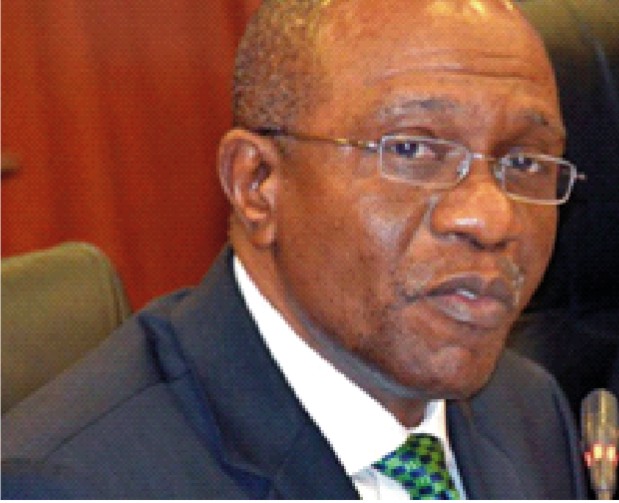

Speaking at the disbursement ceremony, the Governor, CBN, Mr. Godwin Emefiele, said the YEDP was introduced in March 2016 by the apex bank as part of efforts to reduce the nation’s un-employment rate, which had increased to 13.3 per cent in the second quarter.

Speaking through the Deputy Governor, Corporate Services, Alhaji Suleiman Barau, who represented him, Emefiele said the programme was to ensure that the creative energies of the over 64 million Nigerian youths were harnessed to stimulate growth, address restiveness and promote economic development.

“To realise this objective, the bank, in partnership with the National Youth Service Corps and Heritage Bank, began the pilot seven months ago to inspire and harvest the entrepreneurial abilities of Nigerian youths towards creating over one million direct jobs by 2020.

“The programme is open to youths of between 18 and 35 years who are serving corps members, graduates or artisans. All youths in this category are eligible to apply and will be pre-qualified for training on entrepreneurship before they can access credit lines of up to N3m at a single digit interest rate.

“The programme is premised on the provision of timely and affordable credit to identified youth entrepreneurs with expected multiplier effects on job creation and economic growth,” he said.

The CBN boss added that, “To overcome the bottleneck of collateral requirements for loans and ease access to finance, their academic and the NYSC certificates, third-party guarantees and movable assets are allowed as acceptable collateral under the programme.

“The programme is a revolving fund with a target to create more than one million direct jobs. We encourage all Nigerian youths that are interested in being their own bosses to apply online through the participating banks.”

Emefiele said the central bank had commenced the YEDP with other Deposit Money Banks such as Sterling Bank Plc and Fidelity Bank Plc, adding that discussions were ongoing with other banks to open their portals for the programme in order to have a wider outreach and fund more small businesses.

On his part, the Managing Director, Heritage Bank, Mr. Ifie Sekibo, said the bank had received more than 7,000 applications for the second batch of the programme, adding that the lender would soon be meeting with the CBN to expand the reach of the programme.

Sekibo, who was represented by the Executive Director, Lagos & Southwest, Corporate Banking, Heritage Bank, Mrs. Mary Akpobome, gave an assurance that some issues raised by some of the beneficiaries would be addressed.

Director-General, NYSC, Brig.-Gen. Sule Kazaure, while speaking encouraged the beneficiaries to remain focused and ensure that the loans were repaid to make for the extension of similar facilities to other corps members.