… As govt proposes tax on consumables

By: Felix Ikpotor

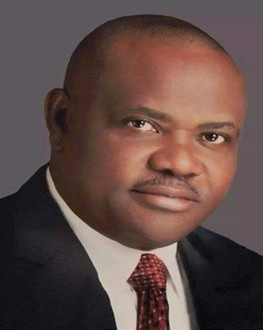

In a bid to generate revenue and divert the economy from oil and coupled with the retrenching economy in the country, Rivers State Governor, Nyesom Wike may have taken the drive for revenue to food vendors, hoteliers and other hitherto overlooked business entities.

This is even as the governor has sent two bills to the Rivers State House of Assembly, RVHA, seeking the assembly to grant the government power to impose and collect taxes from business organisations such as food vendors, hotels, event centres, viewing centres amongst others.

Sections of the bill also seek to impose tax on consumables in the various hotels that make up the state.

The two bills are the Rivers State Hotel Occupancy and Restaurant Consumption Bill, 2016 and the Rivers State Taxes and Miscellaneous Bill, 2016.

Already, a human right activist, Ken Atsuwete and a labour leader in the state, Comr. Chika Onuegbo has kicked against the bills, positing that it is an attempt by the government to pass the buck of the economic hardship on the citizens and double taxation

Leader of the Assembly, Martins Amaewhule presented the two bills unbehalf of the government.

While debating on the bill during plenary on Thursday, Amaewhule said the bill seeks to look at areas the state government has been owed taxes and debts, adding that the house needs to empower the Rivers State Internal Revenue Service, RSIRS, to go after these organisations and recover the taxes.

He maintained that the government meant well as the bill would help to increase revenue for the state.

In his debate, the member representing Emohua Constituency, Samuel Ogeh called the attention of the house to a subsisting judgement challenging the power of the house to legislate on areas except that which is prescribed by the constitution and however, maintained that the house has the power to legislate on other items listed in the bill except that on Social Contributory Tax which is a subject of litigation.

Ogeh also posited that the bill will raise the revenue base of the state considering the fact that revenue from the Federal Government has fallen, stressing that it is does not amount to double taxation.

However, the member representing Khana Constituency1 in the house, Barieene Deeyah expressed reservation, pointing out that hotels remain the highest employer of labour in the state at the present.

While calling on the assembly to look at the bill critically, Deeyah reminded the lawmakers that already, the hotels are paying property tax, stressing that the law should not create a situation whereby they would capitalise on it to retrench workers.

The speaker, Dabotorudima Adams in his ruling said the laws are meant to increase the revenue base of the state and committed the bills to committees to handle.